where to find betterment tax documents

Schedule K-1 is a schedule of IRS Form 1065 US. The amount you paid for that health coverage.

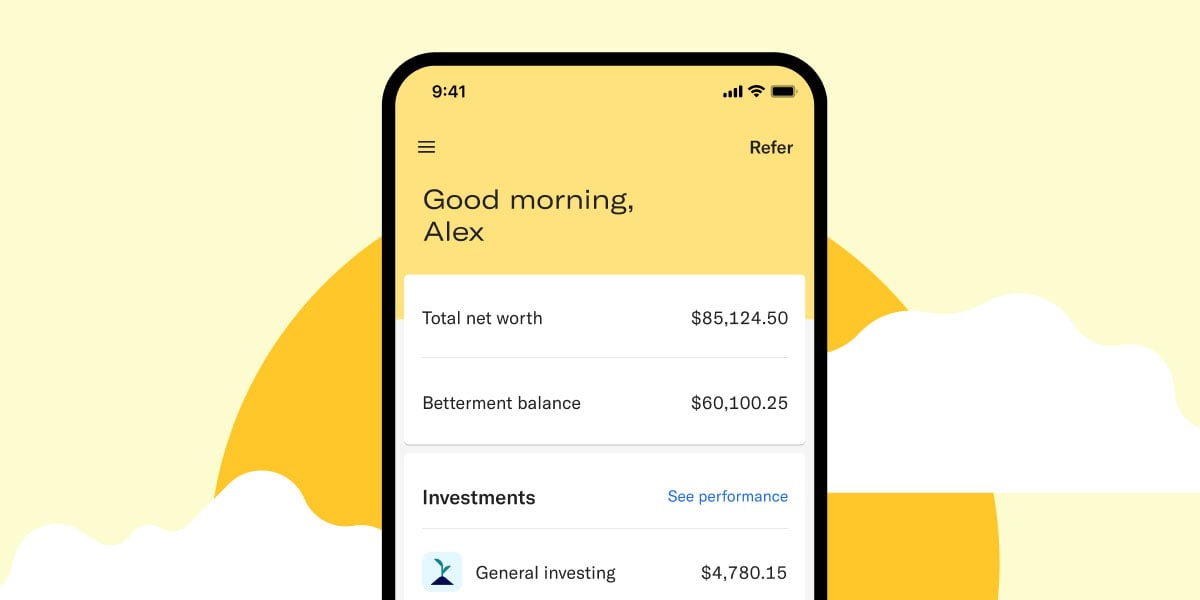

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

If you have a personal.

. Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Complete your tax return. You may be able to take the Credit if.

Well help you decide which ones best for you when you go through this section. The most secure way of passing along documents is the most time-tested one. Or under age 65 years old and are permanently and totally disabled.

This analysis was updated to contain the November 4th amended changes to the cap on the state and local tax SALT deduction. If you and your dependents had qualifying health coverage for all of 2021. In most cases taking the credit works out better than the deduction.

State postal code in which the interest was earned should be entered for Betterment Securities. Hand them directly to the recipient. Check the Full-year coverage box on your federal income tax form.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. You can put this tactic to work by personally delivering your. Scroll down to the Tax.

For example the correct address with the four. Nationwide Municipal Bond ETFs. Down the left side of the screen click on Federal.

Your amended return will take up to. These two forms will determine the amount of your tax credit. SPDRS Tax Exempt Interest by State.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. You andor your spouse are either 65 years or older. Note that we do not currently support integration with.

With Betterment you can automatically import your tax information into TurboTax. Use your 1095-A to file Form 8962 with your tax return. Check the status of your Form 1040-X Amended US.

The bank provided Form 1098 which listed the 7280 in loan interest. Make sure your return gets to the right place as quickly as possible by including the last four digits after the five-digit zip code. 2021 health coverage your federal taxes.

Across the top of the screen click. Individual Income Tax Return for this year and up to three prior years. Youll use your Form 1095-A to reconcile your 2021 premium.

If you choose to take the. Additional fees apply for e-filing. IShares Tax-Exempt Interest by State.

But TurboTax asks for this. Form 1095-A gives you two important pieces of information. November 5 2021.

The soonest you can start importing is Feb. Every tax year Betterment will generate and make available to you the required 1099-B and 1099-DIV tax forms for the TIN or SSN of the trust. Form 5329-T refers to Federal form 5329 for the Taxpayer.

E-sign most forms instead of printing signing and then scanning. State and local taxes. Return of Partnership Income.

Go to the Document tab. Assistance for multilingual taxpayers is also available on the helpline via the Over-the-Phone Interpreter. Sally paid 4500 in state and local taxes and 2000 in property.

Its provided to partners in a business partnership to report their share of a partnerships profits. February 16 2020 311 PM. The total number of months you had health coverage during the year.

When filing your tax return you may be required to report foreign-sourced income which means youll need to report the total of all the foreign-sourced dividend income that you. Schedule B -- Form 1099-DIV Betterment Securities. You must file your taxes and reconcile your 2021 premium tax credits.

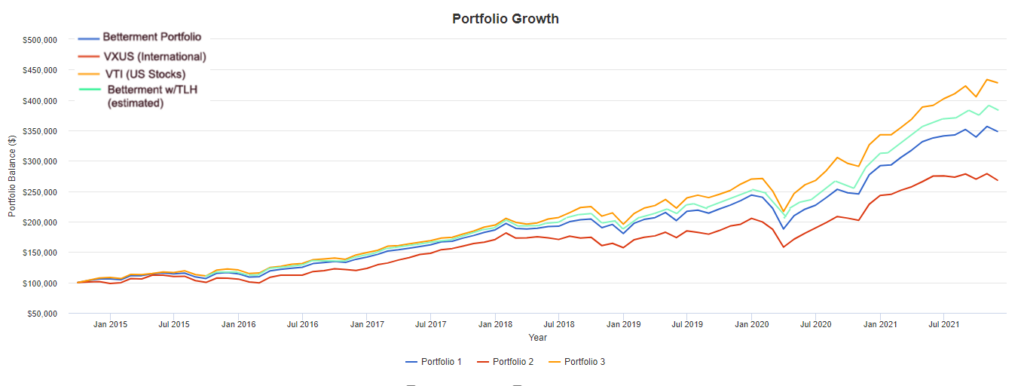

Find your form 1095-A online. Upload your documents 247 instead of faxing or mailing them. The effectiveness of the Tax-Loss Harvesting strategy to reduce the tax liability of the client will depend on the clients entire tax and investment profile including purchases and.

Reports information on health coverage including period of coverage and for whom coverage was provided- including each dependent. If you file a paper return you can get Form 8962 here. Taxpayers who need accessibility assistance can call 833-690-0598.

Link your online bank accounts and tax. You can find it on.

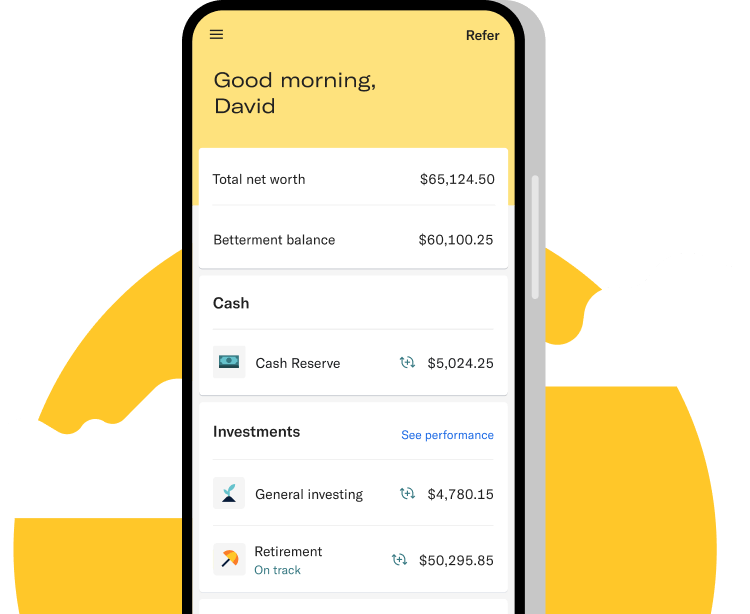

Betterment Mobile App Investing On The Go

The Betterment Experiment Results Mr Money Mustache

Betterment Review Smartasset Com

Betterment Taxes Explained 2022 How Are Investment Taxes Handled

Betterment Review How It Works Pros Cons

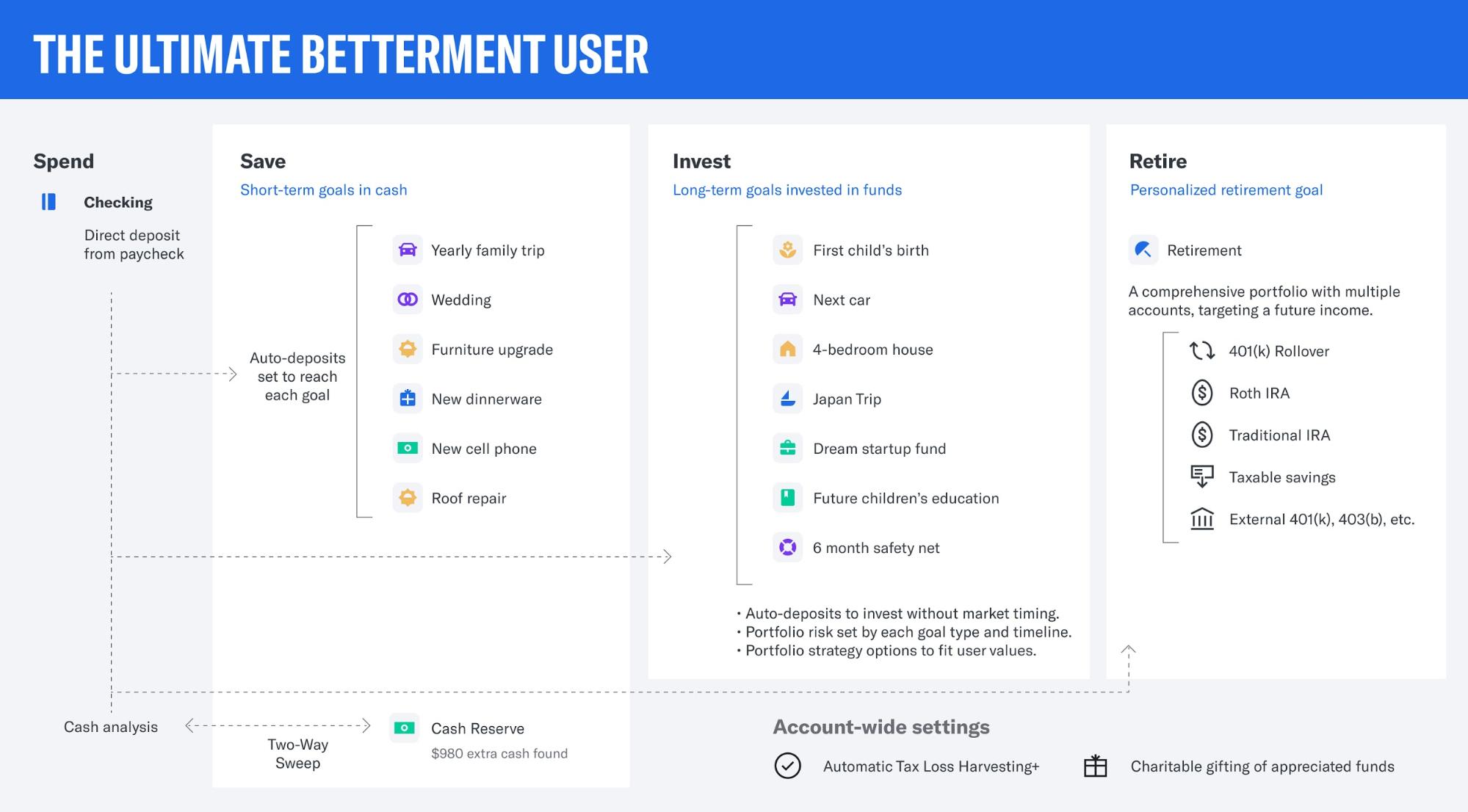

What The Ultimate Betterment User Looks Like

Betterment Review 2022 Is It Really A Smarter Way To Invest

Betterment Announces Record Growth In Q1 2021 Net New Clients Up More Than 100 Yoy

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Tax Smart Investing With Betterment

Betterment Review Smartasset Com

Why Has Betterment Frozen Checking Account Applications Forbes Advisor

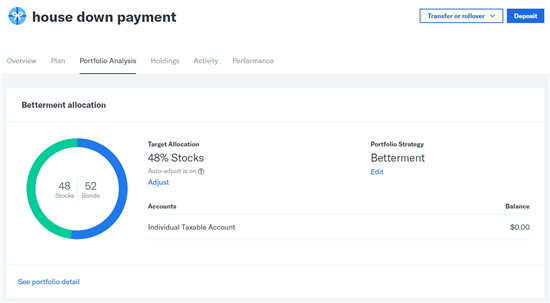

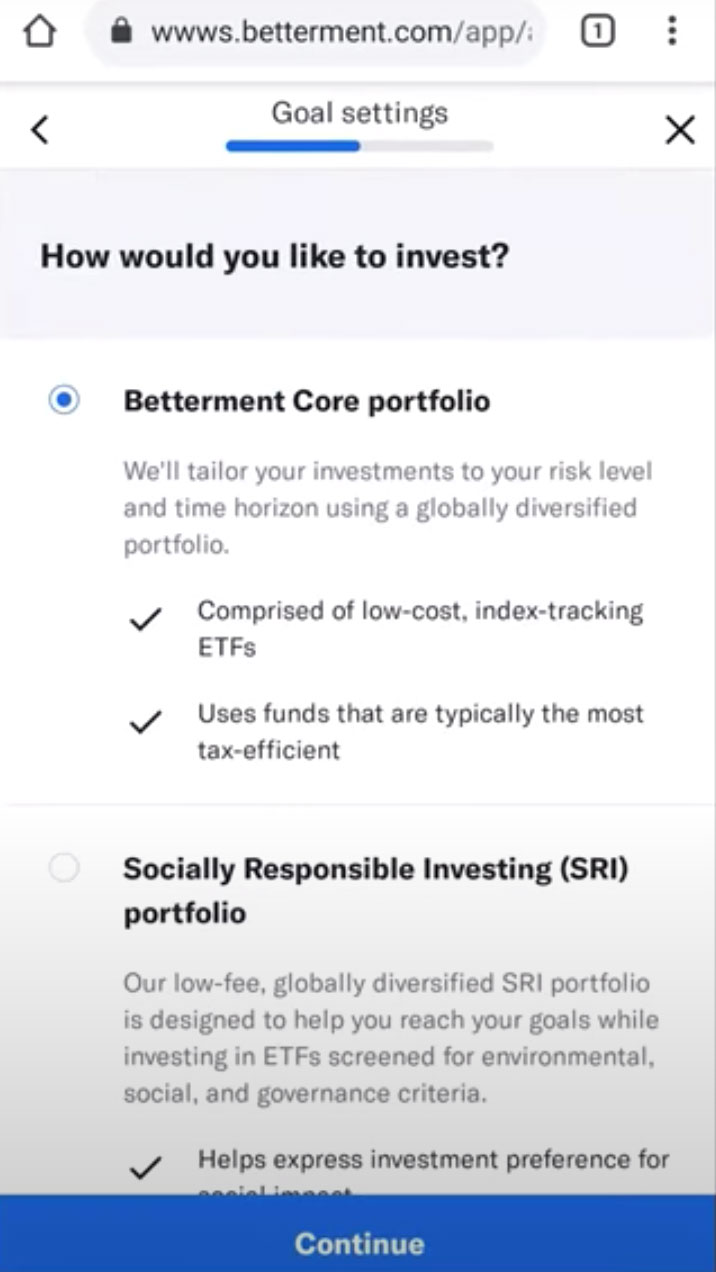

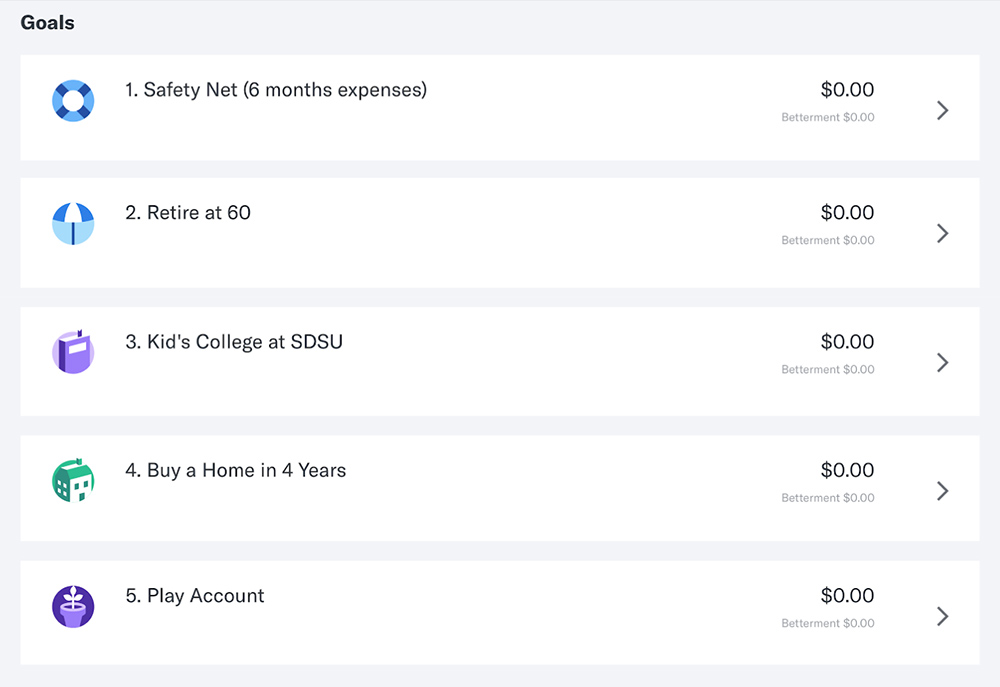

How To Set Up Your Investments Correctly At Betterment

Betterment Review 2022 How It Works Pros And Cons And My Honest Opinion

Betterment Announces Record Growth In Q1 2021 Net New Clients Up More Than 100 Yoy

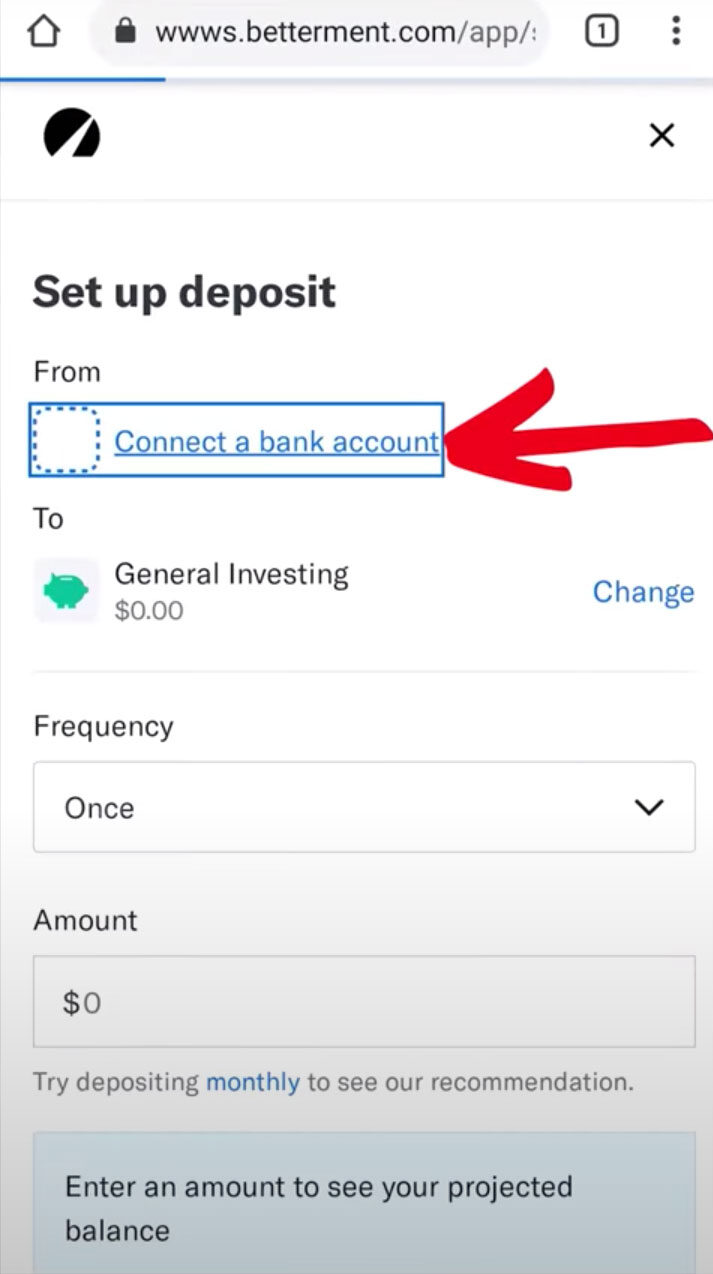

How To Open An Account With Betterment

What The Ultimate Betterment User Looks Like